In a world where managing personal finances has become increasingly complex, finding a tool that simplifies budgeting can make a huge difference. CalendarBudget Basic is a user-friendly, web-based budgeting software designed to help individuals and families take control of their financial lives. By combining the ease of a calendar interface with powerful budgeting tools, CalendarBudget Basic offers an intuitive approach to managing money, tracking expenses, and planning for the future.

In this article, we’ll take an in-depth look at the features, benefits, and overall functionality of CalendarBudget Basic, and why it’s an excellent choice for those looking to simplify their personal finance management.

What is CalendarBudget Basic?

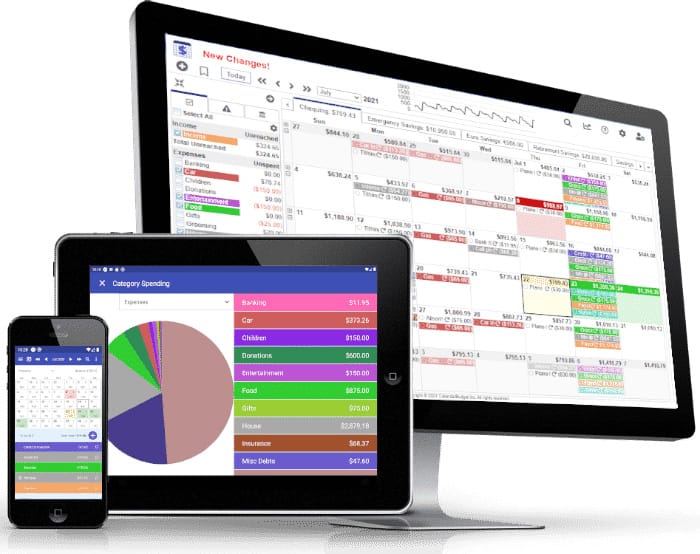

CalendarBudget Basic is a streamlined version of CalendarBudget’s personal finance management software. It allows users to easily track their income, expenses, and savings by organizing their finances through a calendar-based interface. Unlike complex spreadsheets or confusing financial apps, CalendarBudget Basic is designed with simplicity in mind, offering a clear overview of your financial health at a glance.

Its focus on ease of use makes it perfect for beginners or those who prefer a straightforward approach to managing their money without unnecessary features or overwhelming data.

Key Features of CalendarBudget Basic

1. Calendar-Based Interface

The core feature of CalendarBudget Basic is its visual calendar interface. All income and expenses are plotted on specific dates, allowing you to see when money is coming in and going out. This daily view of your finances helps you easily identify patterns, such as periods of overspending or times when bills tend to cluster, and adjust your budgeting accordingly.

2. Automatic Budget Tracking

Once you enter your income and expense categories, CalendarBudget Basic automatically tracks your spending habits. By associating each transaction with a specific date, it gives you a running balance of your account, helping you stay on top of your budget without the need for manual calculations.

3. Customizable Categories

You can create and customize categories for various types of income and expenses, such as groceries, utilities, rent, entertainment, and more. This helps you categorize your spending and get a detailed breakdown of where your money is going each month.

4. Recurring Transactions

With CalendarBudget Basic, you can set up recurring transactions for bills and income. This is particularly helpful for managing fixed monthly expenses like rent, mortgage payments, and utility bills, as well as regular paychecks. Once entered, these recurring transactions will automatically populate your calendar, reducing manual entry and making future planning easier.

5. Mobile-Friendly

CalendarBudget Basic is designed to work smoothly across devices, including smartphones and tablets. This allows you to track and manage your finances on the go, giving you the flexibility to update your budget from anywhere, anytime.

6. Real-Time Financial Overview

By showing all upcoming expenses and incomes on a calendar, CalendarBudget Basic provides a clear overview of your financial situation in real-time. This helps you avoid surprises by seeing upcoming bills before they’re due and ensuring that you have enough funds to cover them.

Benefits of Using CalendarBudget Basic

1. Simple and Intuitive

One of the standout features of CalendarBudget Basic is its simplicity. Unlike other budgeting tools that may come with a steep learning curve, CalendarBudget Basic is intuitive and easy to use. Its calendar format is familiar, making it accessible even for users who have little experience with personal finance tools.

2. Visual Budgeting

The calendar layout provides a visual representation of your cash flow, which can be much more effective for understanding your financial patterns compared to traditional lists or tables. This helps users better manage their money by clearly showing when they may be at risk of overspending or running short before the next paycheck.

3. Stay on Top of Bills

CalendarBudget Basic helps prevent late fees and missed payments by visually displaying when bills are due. By logging all your recurring and one-off expenses, you can ensure you’re always prepared for upcoming financial obligations.

4. Tailored to Your Financial Goals

With the ability to create customizable categories and plan for future expenses, CalendarBudget Basic helps users tailor their budgets to meet specific financial goals. Whether you’re saving for a vacation, paying down debt, or just trying to live within your means, the platform provides the tools to keep you on track.

5. Accessible Anytime, Anywhere

Since CalendarBudget Basic is web-based, you can access it from any device with an internet connection. Whether you’re at home, at work, or on the move, your budget is always accessible, making it easy to update or review your finances whenever necessary.

How to Get Started with CalendarBudget Basic

1. Sign Up and Set Up Your Account

To start using CalendarBudget Basic, head over to CalendarBudget’s website and sign up for an account. The setup process is straightforward and only takes a few minutes. After signing up, you’ll be prompted to enter your basic financial information, such as income sources, expenses, and bank balances.

2. Enter Your Income and Expenses

Once your account is set up, you can begin by entering your income, recurring expenses, and any other financial obligations. CalendarBudget Basic will automatically plot these on the calendar and provide an initial overview of your cash flow.

3. Customize Your Budget

After entering your data, you can customize your budget categories to fit your personal spending habits. The more specific you are, the more insight you’ll gain into where your money is going each month.

4. Track and Adjust as Needed

As you use CalendarBudget Basic, be sure to track your spending and update any new transactions as they occur. By regularly reviewing your budget, you can make adjustments if necessary and ensure that you’re staying on track with your financial goals.

Is CalendarBudget Basic Right for You?

If you’re looking for an easy, visual way to manage your money without the complexity of traditional budgeting software, CalendarBudget Basic may be the perfect solution. Its user-friendly design, combined with practical features like recurring transactions, custom categories, and mobile accessibility, make it an excellent tool for individuals and families alike. Whether you’re budgeting for the first time or seeking a simpler method to stay organized, CalendarBudget Basic offers a clear and straightforward approach to personal finance management.

Conclusion

CalendarBudget Basic is an effective and simple tool for anyone looking to take control of their finances. With its intuitive calendar interface, automated tracking, and flexible features, it offers a hassle-free way to budget, track expenses, and plan for future financial goals. Whether you’re managing day-to-day expenses or planning for long-term savings, CalendarBudget Basic makes personal finance easy to understand and manage.